Michael Alberts, President and CEO of Jewett City Savings Bank, announced that the Bank made five donations totaling $137,094.99 to local nonprofit organizations in support of their energy conservation projects.

- The Connecticut Audubon Society received $12,441 towards energy conservation modifications to their facility in Pomfret.

- St. Vincent de Paul Place Norwich, Inc. received $25,000 to assist with the replacement of windows as part of their energy efficiency project.

- Garde Arts Center, Inc. in New London received $14,201.79 to support energy saving lighting, heating, and roofing at the Community Hall.

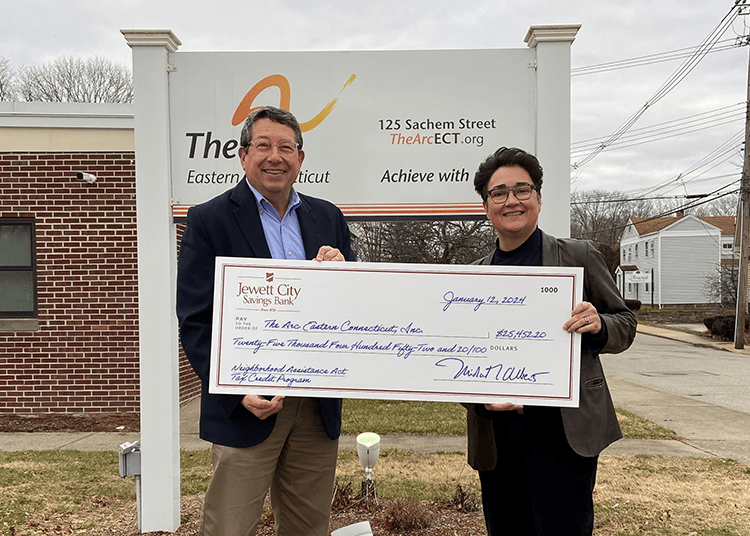

- The Arc Eastern Connecticut, Inc. received $25,452.20 to help replace old windows at a residence for people with intellectual and developmental disabilities.

- United Services, Inc. received $60,000 towards solar energy upgrades at the Dayville clinic.

“Jewett City Savings Bank is dedicated to supporting the nonprofit organizations within the communities we serve, including their energy conservation programs,” said Alberts. “These projects not only benefit our neighbors, but have positive economic and environmental impacts on the communities we serve.”

These donations were made as a result of the Bank’s participation in the Connecticut Neighborhood Assistance Act (NAA) Tax Credit Program. The NAA Tax Credit Program allows certain Connecticut corporations to make monetary contributions to municipal and tax-exempt organizations for community programs and energy conservation projects, which have been approved by the Department of Revenue Services (DRS). The corporation may receive a business tax credit, if approved by the DRS, for making the contribution. By participating in the NAA Tax Credit Program, corporations are able to direct their tax dollars to support important programs and projects in their own communities.